What is Index Universal Life?

It’s a life insurance policy first - which provides a Tax Free Death Benefit.

• It has fees, just like all insurance products. Ask for an expense report.

• Your policy’s cash value grows tax deferred.

• You can take out policy loans, tax free, before the age of 591/2.

• You can create income tax free through policy loans.

• It can provide a tax free death benefit that avoids probate.

Six Reasons You Should Have an IUL

1. If you want to supplement your retirement with tax free income.

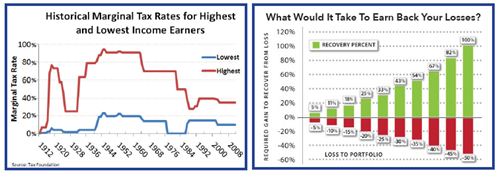

2. If you are concerned about taxation in the future.

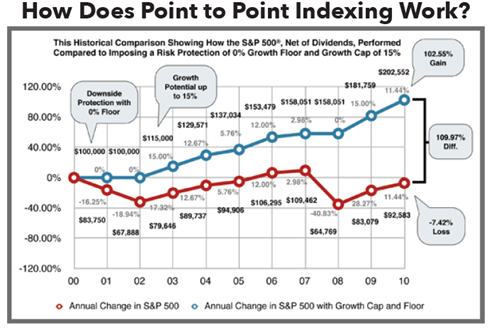

3. If you don’t want negative returns.

4. If you have maxed out qualified contributions.

5. If you are a business and are looking to insure key employees.

6. If you want to leave a legacy for your loved ones.

Indexed Universal Life products are not an investment in the “market” or in the applicable index and are subject to all policy fees and charges normally associated with most universal life insurance. Life insurance policies have terms under which the policy may be continued in force or discontinued. Current risk rates and interest rates are not guaranteed.

Therefore, the planned periodic premium may not be sufficient to carry the contract to maturity. The Index Accounts are subject to caps and participation rates. In no case will the interest credited be less than 0 percent. The policy’s death benefit is paid upon the death of the insured. The policy does not continue to accumulate cash value and excess interest after the insured’s death.